Latest Version

Version

2.3.10

2.3.10

Update

August 13, 2025

August 13, 2025

Developer

The Savings Collaborative

The Savings Collaborative

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.savingscollab

com.savingscollab

Report

Report a Problem

Report a Problem

More About Savings Collaborative

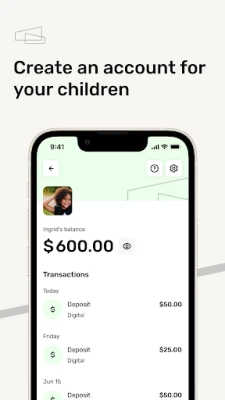

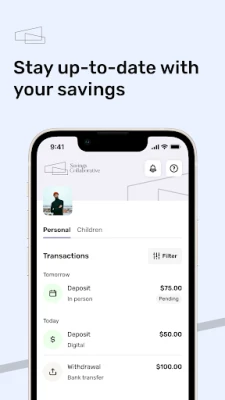

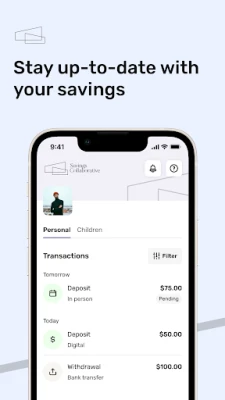

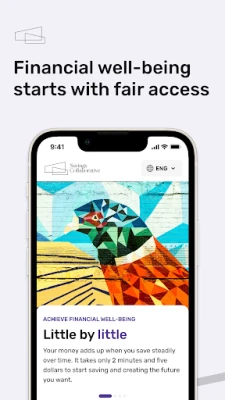

The Savings Collaborative is a non-profit organization that offers a no-fee savings club that makes it easy to save money and develop healthy financial habits. We combine technology with community, education, and personalized guidance from certified financial coaches to help you achieve your financial goals and dreams.

Our emergency loans are designed to help our members in times of need. The loan must be intended to address an emergency or unexpected expense. We offer fixed-interest rate loans at a maximum APR of 6%, compounding monthly. The minimum and maximum repayment period is from 3 to 24 months. There are no upfront or hidden fees and no prepayment penalties. We provide a Truth in Lending Disclosure with all the necessary information about the loan, including the APR, finance charge, amount financed, and total payments.

Here is a sample interest calculation:

Interest = (Principal owed to date * (1 + (APR / 12) ^Months) - Principal owed to date)

In the example provided below, the interest incurred in the first month of payment would be approximately $22.50:

($4,500 * (1 + (0.05999 / 12)^1) - $4,500) = $22.50

Here is an example of our Truth in Lending Disclosure that we provide to borrowers:

Truth in Lending Disclosure

1. The Annual Percentage Rate APR is 5.999%

2. The total interest charged (also known as the finance charge) over the loan is $286.56

3. The amount borrowed (also known as the amount financed) is $4,500

4. The total payments (interest charges plus repayment of loan principal) are $4,786.56

5. The loan repayment period (the length of time to repay the loan) is 24 months

The Truth in Lending Disclosure terms of the loan are provided in the loan schedule attached to the loan agreement.

Here is a sample interest calculation:

Interest = (Principal owed to date * (1 + (APR / 12) ^Months) - Principal owed to date)

In the example provided below, the interest incurred in the first month of payment would be approximately $22.50:

($4,500 * (1 + (0.05999 / 12)^1) - $4,500) = $22.50

Here is an example of our Truth in Lending Disclosure that we provide to borrowers:

Truth in Lending Disclosure

1. The Annual Percentage Rate APR is 5.999%

2. The total interest charged (also known as the finance charge) over the loan is $286.56

3. The amount borrowed (also known as the amount financed) is $4,500

4. The total payments (interest charges plus repayment of loan principal) are $4,786.56

5. The loan repayment period (the length of time to repay the loan) is 24 months

The Truth in Lending Disclosure terms of the loan are provided in the loan schedule attached to the loan agreement.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Carb Manager–Keto Diet TrackerWombat Apps LLC

Fruit Merge-Juicy Melon PuzzleMagicLab

Diet Doctor — low-carb & ketoDiet Doctor

Programming Hero: Coding FunProgramming, Coding, and Coding Games

Healthify: AI Diet & FitnessHealthifyMe (Calorie Counter, Weight Loss Coach)

Foodvisor - Calorie CounterFoodvisor

Glide for Real Estate AgentsGlide Android Team

Scratch Card Masters - ScratchPixel Storm

ScratchJrScratch Foundation

Disgaea 4: A Promise Revisited株式会社日本一ソフトウェア

More »

Editor's Choice

Life ObjectivesOsama Remlawi

Make Money: Play & Earn CashMode Mobile: Make Money On Earn App

Tellus: Earn More DailyTellus App, Inc.

My LevitonLeviton Manufacturing Co., Inc.

NeuroNation - Brain TrainingNeuroNation

Apple TVApple

NetflixNetflix, Inc.

Portal AVIRamiro Neto

Avi Medicalavi medical

Genetics SaleHandbid Inc.